Showing all 5 resultsSorted by price: high to low

-

Hybrid Long Term Care Insurance vs Traditional Long Term Care Insurance

Did you know that is more than one option when it comes to long term care insurance?

With the traditional long term care insurance you pay your premium, and if you need long-term care due to age or illness, the policy pays out a daily or monthly benefit. Some people think that if they die without needing long-term care, they feel they’ve “wasted” the premiums.

-

Fact vs Fiction About Long Term Care Insurance

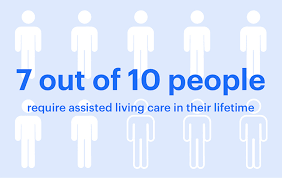

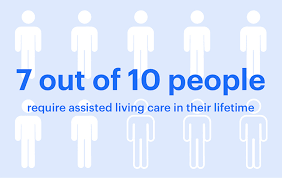

Learn the facts about your need for Long Term Care

-

-

How Much Long Term Care Insurance is Enough?

When it comes to insurance there isn’t a one-size fits all approach. This is especially true when it comes to long-term care insurance.

-

What is Long Term Care Insurance?

As we age, the likelihood we will need some type of medical or personal care increases. We may need long term care – a variety of services which help meet the medical and non-medical needs of people with a chronic illness or disability who cannot care for themselves for long periods of time. Such services typically include assistance with normal daily tasks like dressing, bathing, and using the bathroom. Long-term care can be provided at home, in the community, in assisted living facilities or in nursing homes.