Showing all 22 resultsSorted by price: high to low

-

Good communication is an important part of the healing process. When a doctor and patient work as a team, they are more likely to achieve better health outcomes. Use the links below to get tips for patients on talking with your doctor, tips for health care professionals on working with older patients, and other free…

-

$0.00

Medicare & NYSHIP

Are you becoming eligible for Medicare due to turning 65, disability, or a diagnosis of End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS)? This page has information about how your Medicare benefits will work with your NYSHIP coverage.*

Medicare becomes your primary insurer when you are eligible for Medicare and enrolled in NYSHIP as a retiree, vestee, dependent survivor, or are covered under Preferred List provisions. To coordinate Medicare with your NYSHIP benefits, you should make sure that you:

- Contact the Social Security Administration (SSA) to enroll in Medicare three months before your birthday month. Visit https://www.ssa.gov/onlineservices or call 1-800-772-1213.

- Enroll in Medicare Parts A and B (be sure not to decline Part B).

- If you are eligible for Medicare before age 65, you must notify the Employee Benefits Division that you have enrolled in Medicare Parts A and B, and provide a copy of your Medicare card.

- Do not sign up for any non-NYSHIP Medicare Advantage Plan or Part D prescription plan.

-

Generic vs. brand-name drugs: what’s the difference?

Did you know that prescription drug prices in the U.S. are an average of 2.5 times higher than other Western countries?1 With this in mind, you might be wondering if switching to a generic drug is right for you. Let’s take a look at the differences between the generic and brand-name versions of prescription drugs.

-

Parts Of Medicare 2Min Video

A 3 minute overview of the various parts of Medicare

-

Hybrid Long Term Care Insurance vs Traditional Long Term Care Insurance

Did you know that is more than one option when it comes to long term care insurance?

With the traditional long term care insurance you pay your premium, and if you need long-term care due to age or illness, the policy pays out a daily or monthly benefit. Some people think that if they die without needing long-term care, they feel they’ve “wasted” the premiums.

-

Fact vs Fiction About Long Term Care Insurance

Learn the facts about your need for Long Term Care

-

-

How Much Long Term Care Insurance is Enough?

When it comes to insurance there isn’t a one-size fits all approach. This is especially true when it comes to long-term care insurance.

-

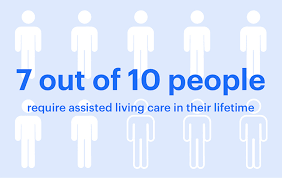

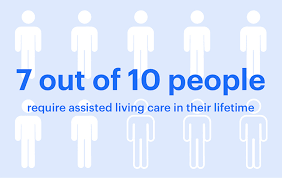

What is Long Term Care Insurance?

As we age, the likelihood we will need some type of medical or personal care increases. We may need long term care – a variety of services which help meet the medical and non-medical needs of people with a chronic illness or disability who cannot care for themselves for long periods of time. Such services typically include assistance with normal daily tasks like dressing, bathing, and using the bathroom. Long-term care can be provided at home, in the community, in assisted living facilities or in nursing homes.

-

Choosing Dental Coverage

Proper dental care can be an important component of our well being. As with all insurance-related decisions, there are multiple facets that should go into your decision when purchasing coverage for yourself, family, business, or your employees. And, there many types of plans to consider such as a PPO (Preferred Provider Organizations), HMO (Health Maintenance Organization), dental indemnity insurance plans, and discount dental plans.

-

Why it’s Worth Considering Final Expense Insurance

Burial insurance or final expense insurance is a basic life insurance policy that covers people until they reach the age 100. It is an easy insurance to obtain. Depending on the policy, burial insurance or final expense insurance gives your family the ability to cover the expenses of a funeral and potentially other outstanding expenses.

-

Vision Insurance: Is It Right For You

At its most basic level, vision insurance helps cover the cost of routine eye exams, contact lenses and glasses. Some vision plans also pay for corrective procedures such as laser eye surgery. Additionally, most plans include one pair of glasses or contacts a year.

-

Choosing Dental Coverage

Proper dental care can be an important component of our well being. As with all insurance-related decisions, there are multiple facets that should go into your decision when purchasing coverage for yourself, family, business, or your employees. And, there many types of plans to consider such as a PPO (Preferred Provider Organizations), HMO (Health Maintenance Organization), dental indemnity insurance plans, and discount dental plans.

-

Different Types of Health Plans – HMO, PPO, EPO,POS

There are different types of Marketplace health insurance plans designed to meet different needs. Some types of plans restrict your provider choices or encourage you to get care from the plan’s network of doctors, hospitals, pharmacies, and other medical service providers. Others pay a greater share of costs for providers outside the plan’s network. Here is an overview of the types of marketplace plans available to you.

-

$0.00

Plans A, B, C, D, E, F, G, K, L, M, N Summary Page

-

HMO’s, PPO’s, DSNP’s, PFFS

-

$0.00

Part D Prescription Drug Plans You can sign up for Part D Prescription Drug Plans, which helps cover prescription drug costs, along with other components of Medicare starting three months before your 65th birthday. It’s important to do this on time because there’s a permanent premium surcharge for enrolling more than three months after your…

-

-

$0.00

Special Enrollment Period Cheatsheet

-

$0.00

What is Medicare Supplement (Medigap) Insurance? A Medicare Supplement (Medigap) insurance, sold by private companies, can help pay some of the health care costs that Original Medicare doesn’t cover, like co-payments, coinsurance, and deductibles. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for…